Activity statements – what do I need to know?

May 3, 2023What are activity statements?

Activity statements are issued by the ATO so that businesses can report and pay several tax liabilities on the one form at the same time. There are 3 types of activity statements:

- Pay As You Go (PAYG)

- Business Activity Statement (BAS)

- Instalment Activity Statement (IAS)

Pay As You Go (PAYG)

The PAYG Withholding Tax is a system in Australia to collect income tax from employees and businesses throughout the year. Both PAYG withholding tax, as well as the PAYG instalments are reported to the ATO on Activity Statements.

Employers are required to deduct a certain amount of tax from their employee’s pay and remit it to the ATO. The amount of tax withheld is based on the employee’s income amount, their tax file number (TFN) declaration and any other relevant information such as tax deductions.

PAYG Instalments are regular prepayments made by businesses and individuals towards their expected tax liabilities. Taxpayers are required to estimate their expected tax liability for the current financial year and make regular payments towards that amount. The amount of each instalment is based on the taxpayer’s actual or estimated income for the year and can be calculated using the Instalment Amount or the Instalment Rate.

The Instalment Amount requires taxpayers to pay a fixed amount each period based on their estimated tax liability for the year. This is calculated using the ATO’s instalment rate, which is based on the taxpayer’s previous year’s tax liability and the current year’s income.

The Instalment Rate requires taxpayers to pay an amount each period that is calculated as a percentage of their actual income for that period. This option is suitable for taxpayers whose income fluctuates throughout the year.

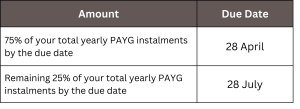

Due dates for PAYG will depend on your lodgment periods. The ATO will send you a letter either via mail or myGov. This letter will state how often you need to lodge and pay.

Due Dates:

Quarterly Lodgments

Business Activity Statements (BAS)

A BAS is a form used in Australia by business to report and pay various taxes to the ATO, including GST, PAYG withholding and instalment, and other taxes. The form requires businesses to provide information about their sales and purchases during the reporting period, as well as any tax withheld from payments made to employees, contractors, and other payees. This information is used to calculate the amount of tax owed by the business and to reconcile the amounts of GST and PAYG withholding reported by the business.

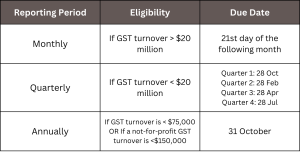

Any business registered for GST is required to lodge a BAS and some businesses who aren’t registered for GST but are for PAYG withholding or other obligations to report.

Your business is required to report monthly, quarterly, or annually dependent on GST Turnover.

Instalment Activity Statements (IAS)

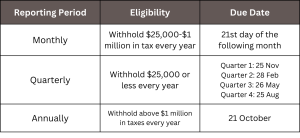

The IAS is a form issued by the ATO. Those who deal with PAYG instalments, withholdings, or FBT instalments and aren’t registered for GST are required to complete an IAS. The IAS summarises this information.

You or your business is required to lodge an IAS depending on your withholding amount.

How to lodge activity statements:

There are 3 different ways you can lodge your activity statements:

- Online: Activity statements are lodged electronically through the ATO’s Business Portal.

- By Mail: Businesses can mail their activity statements to the ATO using the pre-addressed envelope provided with the activity statement form. The ATO recommends that businesses send their activity statements at least five days before the due date to ensure timely delivery.

- Through a tax agent: Businesses can engage a registered tax agent to help them prepare and lodge their activity statements. Tax agents can lodge activity statements on behalf of their clients and can also provide advice and assistance with other tax and compliance matters.

For more information on our tax agent services, contact us.